Commercial Property Depreciation – Commercial property depreciation is a financial concept that reflects the gradual decline in the value of a commercial property over its useful life due to factors like wear and tear and technological advancements.

Property owners often use methods such as straight-line or accelerated depreciation to account for this reduction in value, allowing them to allocate expenses and manage their tax liabilities effectively.

While land value remains constant and is not subject to depreciation, the structures and improvements on the land, such as buildings and fixtures, are depreciable assets.

Depreciation not only helps property owners accurately represent the true financial state of their assets in accounting records but also offers tax benefits by allowing them to deduct a portion of the property’s value from their taxable income.

When dealing with commercial property depreciation, it’s crucial to adhere to the specific regulations and guidelines set by tax authorities in your jurisdiction to ensure accurate financial reporting and compliance.

Commercial Property Depreciation

The commercial property depreciation factor refers to the rate at which a commercial property’s value decreases over its useful life due to factors like wear and tear, obsolescence, and age.

This factor is typically used in depreciation calculations to determine the amount of depreciation expense to be recorded each year.

The depreciation factor depends on the chosen depreciation method, the estimated useful life of the property, and any other relevant factors that impact the property’s value over time.

For example, in straight-line depreciation, the factor would be calculated by dividing 1 by the estimated useful life of the property.

Formula for Straight-Line Depreciation Factor: Depreciation Factor = 1 / Estimated Useful Life

For accelerated depreciation methods like the double declining balance method or the sum-of-the-years-digits method, the factor would be different due to the specific calculations involved.

It’s important to note that different jurisdictions or industries might have specific guidelines for determining depreciation factors for commercial properties.

Additionally, tax regulations, accounting standards, and property characteristics can influence the choice of method and the associated depreciation factor.

Consulting with financial professionals or accountants experienced in commercial property valuation and depreciation can help ensure accurate calculations and compliance with relevant regulations.

Types of Depreciation Methods Commonly Used for Commercial Properties

There are several types of depreciation methods commonly used for commercial properties. Here are a few of the most common ones:

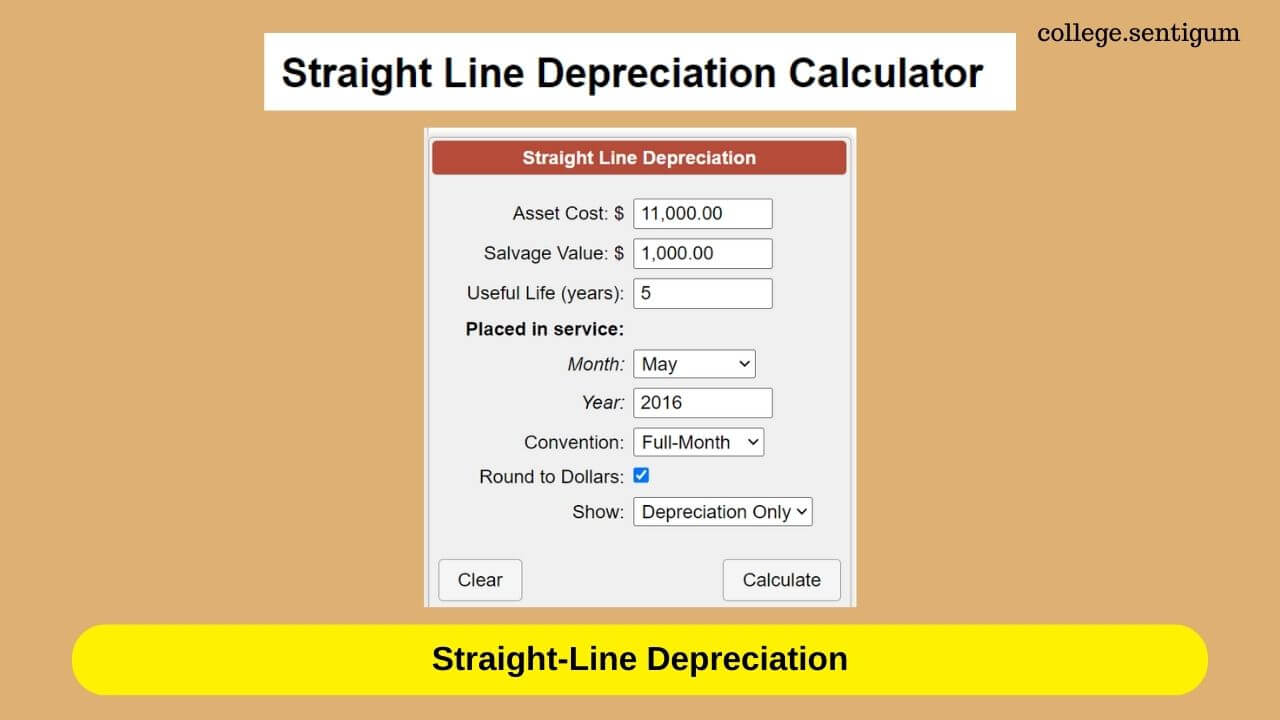

Straight-Line Depreciation

Straight-line depreciation is one of the most common methods used to calculate the depreciation of assets, including commercial properties.

It evenly spreads the cost of an asset over its estimated useful life, resulting in a consistent depreciation expense each year. This method assumes that the asset depreciates at a constant rate over time.

For commercial properties, the straight-line depreciation formula is:

Annual Depreciation Expense = (Original Cost – Residual Value) / Estimated Useful Life

Where:

- Original Cost: The initial cost of acquiring or constructing the commercial property.

- Residual Value: The estimated value of the property at the end of its useful life.

- Estimated Useful Life: The expected number of years the property will be in use before becoming obsolete or needing significant improvements.

The straight-line method is simple to calculate and provides a consistent expense amount, making it easy to plan for financial reporting and budgeting purposes.

However, it might not accurately reflect the actual wear and tear that occurs over time, especially if the property’s value decreases more rapidly in its later years.

It’s important to consider that land, which typically appreciates in value rather than depreciates, is not included in the calculation for straight-line depreciation.

Only the improvements on the land, such as buildings and fixtures, are subject to depreciation.

Straight-line depreciation is often used for accounting and financial reporting purposes.

However, for tax purposes, jurisdictions may require the use of specific depreciation methods, such as Modified Accelerated Cost Recovery System (MACRS) in the United States, which is an accelerated depreciation method.

CLICK HERE to use Straight Line Depreciation Calculator.

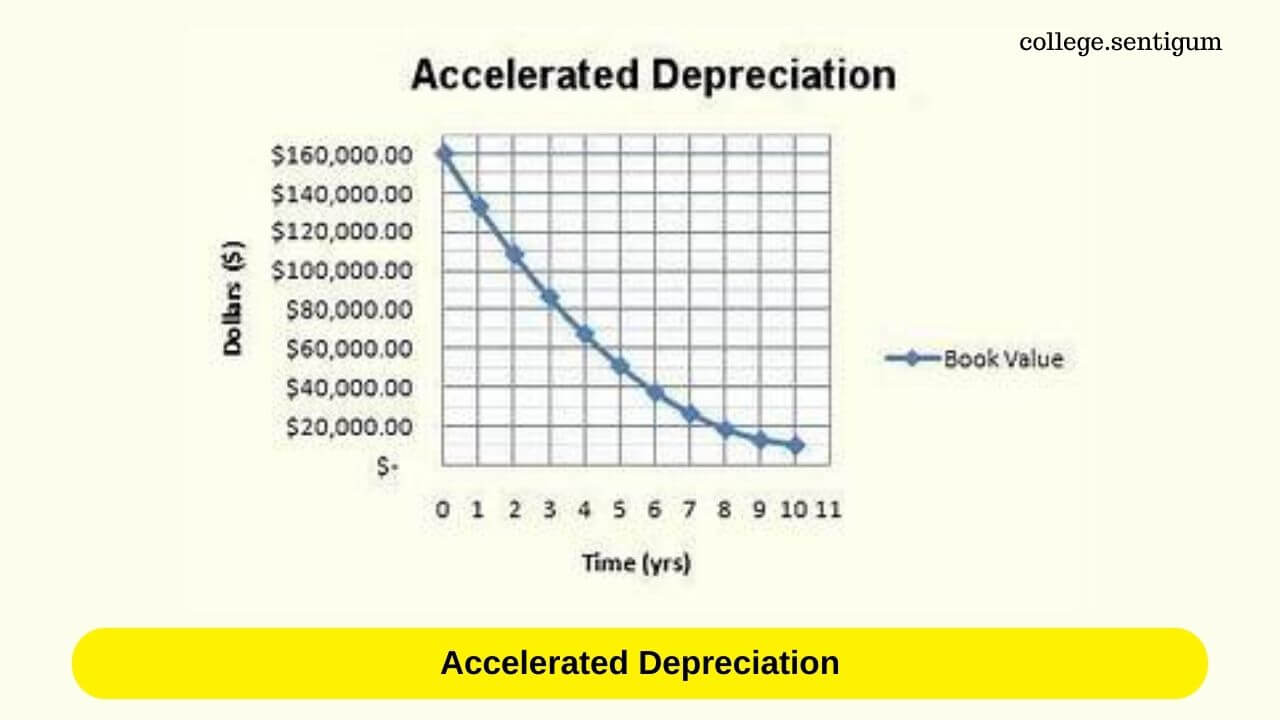

Accelerated Depreciation

Accelerated depreciation is a method used to calculate the depreciation of assets, including commercial properties, where the asset’s value is allocated more rapidly in its earlier years and less rapidly in its later years.

This approach recognizes that assets often lose their value more quickly when they are new and tend to depreciate at a slower rate as they age.

There are various accelerated depreciation methods, with the most well-known being the Modified Accelerated Cost Recovery System (MACRS), used for tax purposes in the United States.

MACRS divides assets into specific recovery periods and assigns higher depreciation rates to those periods.

This results in larger depreciation deductions in the earlier years of an asset’s life, which can have tax benefits for businesses.

For commercial properties, including buildings and other improvements, accelerated depreciation can be more reflective of the actual wear and tear that occurs in the property’s early years.

This is especially relevant when technological advancements or changes in market demand lead to quicker obsolescence.

Keep in mind that the specific rules and rates for accelerated depreciation can vary depending on the jurisdiction and tax regulations.

When using accelerated depreciation methods like MACRS, it’s essential to follow the guidelines provided by tax authorities to ensure compliance and accurate reporting.

While accelerated depreciation provides advantages in terms of tax savings and reflecting real-world value changes, it can make financial planning more complex due to varying depreciation amounts from year to year.

Businesses and property owners often choose between straight-line and accelerated depreciation based on their financial goals, tax strategies, and the nature of their assets.

Consulting with financial professionals or accountants can help determine the most suitable method for a given situation.

Conclusion

In conclusion, commercial property depreciation is a vital financial concept for businesses and property owners.

It involves the gradual reduction in value of a property over time due to wear and tear, technological advancements, and other factors.

The choice of depreciation method, whether it’s the consistent spread of value in straight-line depreciation or the front-loaded approach of accelerated methods, has implications for financial reporting, tax strategies, and budgeting.

Commercial property owners must carefully select the appropriate method based on property characteristics and financial goals while adhering to jurisdiction-specific regulations.

Ultimately, understanding and effectively managing depreciation is essential for accurate financial assessments, tax planning, and informed real estate management decisions.